The Affordable Care Act requires that all health plans sold to individuals or through small employers cover prescription medications. Although not required, prescription drug coverage is almost universal among large employers.Check with your insurance company to see if they require you to use a pharmacy in their network. Pick a pharmacy close to where you live, and let your doctor or hospital know its name and phone number.

Your medical team usually will call the pharmacy directly about the prescription you need. Otherwise, your doctor might give you a written prescription to take to the pharmacy. The prescription coverage under the ACA is insurance — not a discount plan.

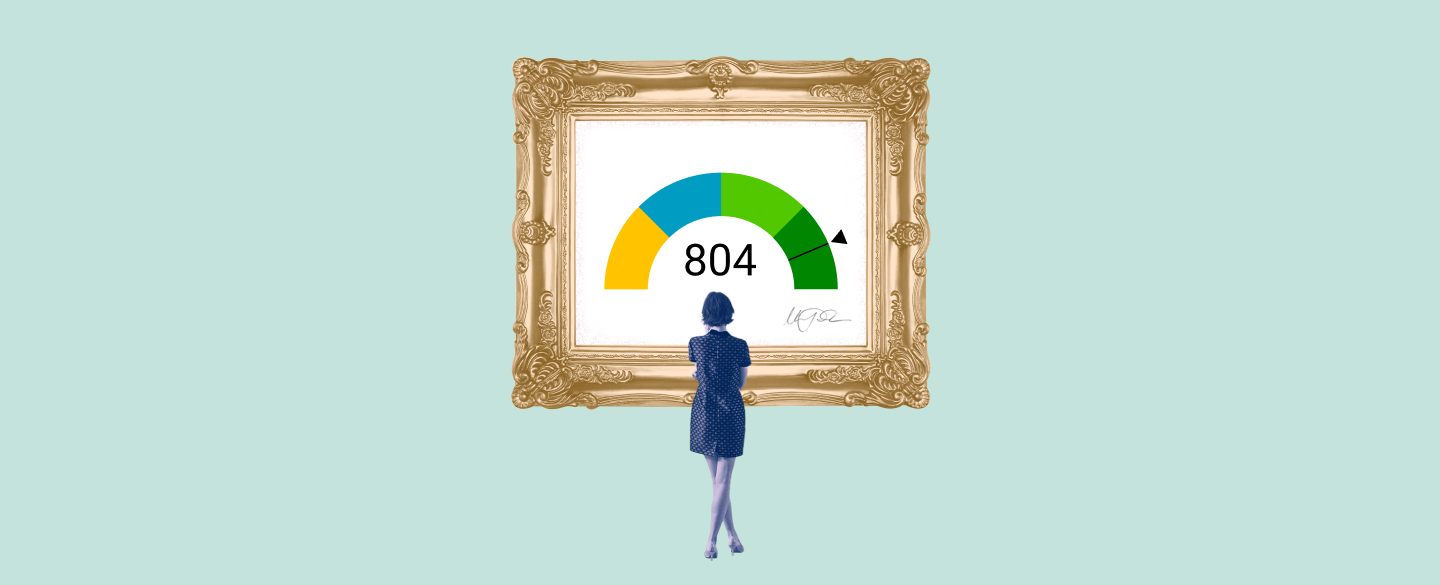

But depending on the plan design, you may have to meet your deductible before the plan starts to pay for your prescriptions. Either way, the maximum out-of-pocket limit on your plan includes spending on prescription drugs. Many times, you can look up which drugs are covered by your prescription drug plan's formulary list and see what your co-payment or coinsurance will be.

A formulary is a prescription drug list that shows all the medications that your plan covers. Many plans provide online resources to help you identify if the drug you were prescribed is on your plan's formulary. Contact your plan if you have questions about your formulary. This is the dollar amount you pay for health care expenses. In most plans, you pay this after you meet your deductible limit.

For example, you pay a set dollar amount to your doctor for an office visit. So, if your copay is $25, you pay that amount when you go to your doctor. Copays are also used for some hospital outpatient care services in the original Medicare plan.

In prescription drug plans, it is the amount you pay for covered drugs. Most health plans are required to cover preventive care without any cost-sharing. This means even if you haven't met your annual deductible, you can still receive preventive care services for free. Preventive care benefits include immunizations, some cancer screenings, cholesterol screening, and counseling to improve your diet or stop smoking.

You may be required to receive the preventive care from a doctor in your plan's network. You can find a list of all the free preventive care services here. Some plans that existed prior to 2010 that have not substantially changed -- known as grandfathered plans -- do not have to provide free preventive services. Check with your insurance company or HR department to find out if your plan is grandfathered. Some plans require use of an in-network pharmacy or designated home delivery pharmacy for coverage to apply. Coverage may be subject to plan deductible, copayment, and/or coinsurance requirements.

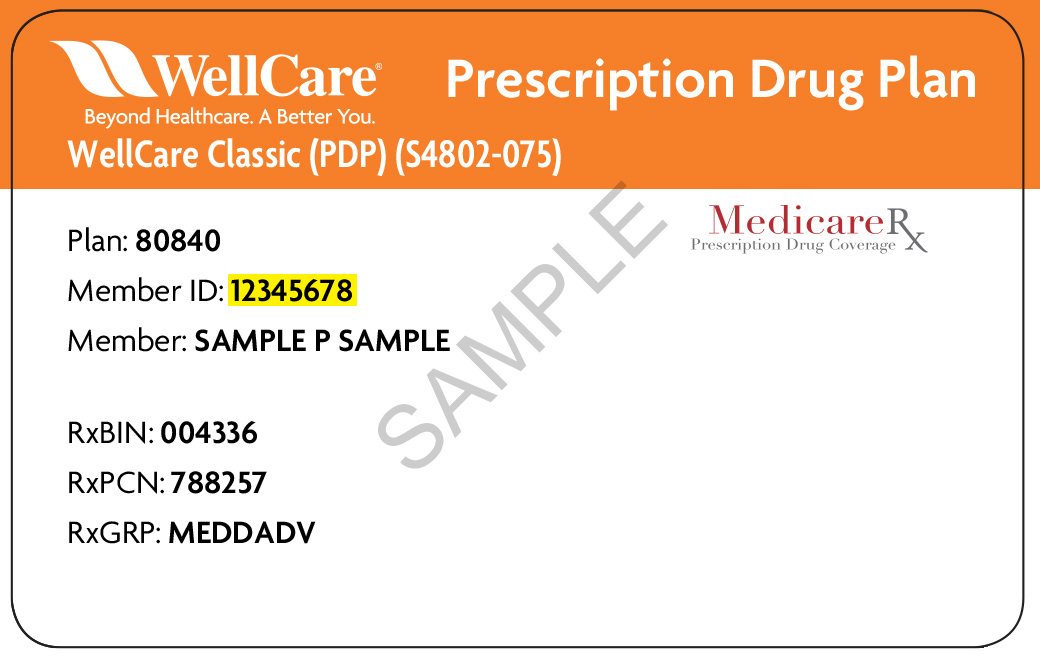

All group health insurance policies and health benefit plans contain exclusions and limitations. Refer to your plan documents for costs and complete details of your plan's prescription drug coverage. Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services.

What Does Rx Group Mean On Insurance Card It's also the number health insurers use to look up specific members and answer questions about claims and benefits. This number is always on the front of the card. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc. In health care terms, the term Rx stands for prescription drugs and medication-based treatment.

This is a vital tool in the arsenal of hospital and outpatient care. Health insurance provides some prescription coverage as required by the Affordable Care Act essential health benefits. A cap on the total benefits you may get from your insurance company over the life of your planfor certain conditions. A health plan may have a total lifetime dollar limit on benefits (like a $1 million lifetime cap) or limits on specific benefits , or a combination of the two. After a lifetime limit is reached, the insurance plan will no longer pay for covered services.

There are no lifetime limits on essential health benefits, such as emergency services and hospital stays. A network is a group of health care providers. The health care providers in the network sign a contract with a health plan to provide services.

Usually, the network provides services at a special rate. With some health plans, people get more coverage when they get care in the network. Every health insurance plan comes with prescription drug coverage, but not every plan covers every medication. And, within a plan, how much you will have to pay for medications will vary, depending on the drug itself. This is why it's important to know how prescription drugs are covered and what to look for to make sure you have the coverage you need when you're choosing a plan.

Drug tiers are important because if most of the medications you take are listed on a higher tier for a particular plan, your out-of-pocket costs may be higher. Not all insurance plans use drug tiers, and not all drug tiers work the same way. Make sure you understand how your plan – or any new health plan you're considering – covers its prescription drugs. If you have questions understanding plan benefits, a trusted eHealth licensed insurance agent would be happy to help. A type of health plan that provides health care coverage to its members through a network of doctors, hospitals and other health care providers.

An HMO may cost less than other plans but has some limitations. This is a list of prescription drugs the health plan covers. It can include drugs that are brand name and generic. Drugs on this list may cost less than drugs not on the list.

How much a plan covers may vary from drug to drug. An open formulary provides a greater choice of covered drugs. Members can get care from any licensed doctor or hospital. They get the same level of benefits no matter who they see. The plan pays a percentage of each covered health care service. These plans often have deductibles, coinsurance and certain benefit maximums.

Obamacare classifies prescription drug insurance coverage as an essential health benefit. Qualified health plans must offer prescription benefits. Insurers set the amount, type, and price of prescription benefits. The rules require disclosure of covered drugs and the dollar amount of copays or coinsurance consumers must pay. When a drug requires prior authorization it means that the health care provider must ask for approval before the drug can be covered. Drugs may require prior authorization because there is an equally effective low cost alternative, there are safety concerns and/or a potential for inappropriate use.

The process for submitting prior authorization requests varies by plan and may be done by phone, fax or electronically. In all cases, providers will need to provide their rationale for covering the drug. The process for submitting a PA request can be found by contacting the health plan or accessing their web site.

Drugs that are not listed on a health plans formulary may be either non-formulary or covered as a medical benefit. Non formulary drugs may be covered if the provider or member requests coverage. MassHealth is a health-care program for people living in Massachusetts who get medical care in Massachusetts. In certain situations, MassHealth may pay for emergency treatment for a medical condition when a MassHealth member is out of state.

If an emergency occurs while you are out of state, show your MassHealth card and any other health-insurance cards you have, if possible. Also if possible, tell your primary care provider or health plan within 24 hours of the emergency treatment. If you are not enrolled in a health plan through MassHealth, but instead get premium assistance, your private health insurance may also pay for emergency care you get out of state. Also known as independent practice association.

This is a group of doctors or other health care providers. They contract with one or more health plans to provide services. A member who sees a primary doctor in this group will be referred to specialists and hospitals in the same group. Members can go outside the group if the group can't handle their medical needs. Everybody with health insurance should have a doctor who will oversee their medical care. That means you will need to find a doctor -- also called your primary care physician -- who is taking on new patients.

If you have young children, you will need to find a pediatrician or family practice physician for their care. Call doctors on the list your insurance company gives you to confirm they are still in the plan's network. Once you've found a doctor who will take you as a patient, set an appointment for your first checkup. Unlike private health insurance plans, Original Medicare does not cover prescription drugs.

Medicare Part D was established in 2003 to provide prescription coverage for Medicare enrollees and requires buying a private prescription plan. Prescription drug insurance is similar to medical insurance. You pay a premium, and then you pay a copay when you fill a prescription.

If you are insured through a large employer group plan, prescription drug coverage may be a separately-administered plan or integrated with your medical insurance. This is a type of limit that some health plans have. It is the most the plan will pay for prescription drugs for a period of time. If a member's drug costs reach that limit within the time period, the plan will not cover the drug costs for the rest of that time. It's the identifier that lets healthcare providers verify the health insurance coverage and make the needed payment arrangements for the health care services provided.

Each insurance company has different rules for using health care benefits. In general, you will give your insurance information to your doctor or hospital when you go for care. The doctor or hospital will bill your insurance company for the services you get. To avoid those costs, look at the list of prescription drugs covered by your health insurance plan. The ACA set a standard of essential health benefits, which includes prescription drug coverage on all new individual and small group health plans since 2014—the year the act took effect. The most you have to pay for covered services in a plan year other.

After you spend this amount on deductibles, copays and coinsurance, your health plan pays 100 percent of the costs of covered benefits. For plans that cover more than 1 person, individual out-of-pocket maximums counts toward the family out-of-pocket maximum. Once the family out-of-pocket maximum is reached, the plan pays 100 percent of the cost of covered benefits for everyone on your plan. The out-of-pocket maximum doesn't include your monthly premium payments or anything you spend for services your plan doesn't cover. This may be a flat rate or a percentage of the cost .

If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider. For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network. This is a doctor, hospital or other health care provider. The provider signs a contract with a health plan. The provider is part of the plan's network for covered services.

People may pay less when they visit this type of provider. Health insurance helps pay for your health care. It can help cover services ranging from routine doctor visits to major medical costs from a serious illness or injury. It also covers many preventive services to keep you healthy. You pay a monthly bill called a premium to buy your health insurance and you may have to pay a portion of the cost of your care each time you receive medical services. You must live in the service area of the Part D plan to enroll, and some plans will have a network of pharmacies they work with.

One way to potentially save money on prescription drug costs is to sign up for a health discount program, such as the GoodRX card. When using a prescription discount card, you can save up to 60% when you use in-network providers to fill your prescriptions. Feel free to give us a call today to speak with a licensed insurance agent on how to sign up for a GoodRX card, or other ways you can save on prescription costs. See how else you can save on prescription drugs with eHealth. Large group plans are not required to cover the ACA's essential health benefits other than preventive care. However, the vast majority of these plans do provide prescription drug coverage.

(In most states, "large group" means an employer-sponsored plan that has at least 51 employees, although there are a few states that set the threshold for large group at 101 employees. A health plan that supplies services at a higher level of benefits when members use contracted health care providers. They do not have to name a primary care physician. Members who go to network providers usually get more coverage.

Also known as preferred provider organization. Also known as health maintenance organization. This is a health plan that arranges health care services for its members.